Tariffs or Taxes? How Import Fees Affect End Consumers

0

0

0

When goods cross borders, they often incur charges—either as tariffs levied for trade policy reasons or as taxes imposed by customs authorities. These import fees can significantly alter the final price consumers pay, yet many shoppers aren’t aware of how much of their bill actually goes toward these extra costs. In this article, we’ll unpack the difference between tariffs and taxes, show how import fees work, and explore their ripple effects on consumer wallets.

Table of Contents

4. Industry Responses and Retail Strategies

5. Government Revenue and Economic Trade‑Offs

6. Future Outlook for Import Fees

1. Defining Tariffs or Taxes

At their core, a tariff is a duty imposed on imports to protect domestic industries or punish unfair trade practices, while a customs tax is typically a revenue‑raising measure. Both increase the cost of goods at the border, but their objectives differ:

Tariffs aim to influence trade flows and support local producers.

Taxes primarily fund government budgets without direct trade policy intent.

2. How Import Fees Work

Import fees combine both tariffs and taxes, applied when a shipment arrives in the importing country. The process involves:

Classification: Customs officers assign a Harmonized System (HS) code to determine the correct duty rate.

Valuation: Duties are calculated against the declared value, often including freight and insurance.

Levying: Tariffs and taxes are added to the importer’s bill, which is usually passed down to retailers and ultimately consumers.

By understanding import fees, businesses can anticipate costs and adjust pricing accordingly.

3. Impact on Consumer Prices

When import fees rise, the added costs rarely vanish:

Price Pass‑Through: Retailers generally pass most of the extra charges on to shoppers.

Product Selection: Some high‑duty items may be withdrawn from market if margins disappear.

Inflationary Pressure: Broad increases in import fees can add to overall consumer price inflation, especially for electronics, apparel, and specialty foods.

4. Industry Responses and Retail Strategies

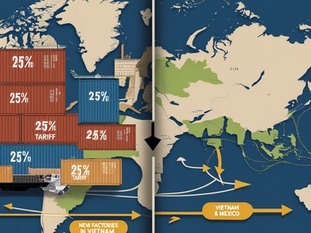

To soften the blow of higher import fees, companies employ various tactics:

Sourcing Shifts: Moving procurement to low‑duty countries or domestic suppliers.

Tiered Pricing: Offering multiple product lines—a premium “all‑inclusive” version and a basic model with fewer features.

Absorbing Costs: In competitive segments, brands may eat part of the fees to maintain market share.

5. Government Revenue and Economic Trade‑Offs

Import fees provide vital revenue—tariffs contributed over $60 billion to the U.S. Treasury in recent years—but they also carry trade‑off implications:

Protection vs. Growth: High tariffs protect certain industries but can stifle consumer spending and overall economic growth.

Regressive Impact: Taxes on everyday imports disproportionately affect lower‑income households who spend a higher share of income on goods.

Negotiation Leverage: Governments can adjust tariffs in trade talks, using import fees as bargaining chips.

6. Future Outlook for Import Fees

As global trade tensions ebb and flow, import fees may rise or fall. Companies and consumers should prepare by:

Monitoring Policy Changes: Stay informed on tariff updates and trade agreements.

Advocating for Exemptions: Industries can petition for relief on critical imports.

Building Agility: Developing flexible supply chains to switch sources quickly when duties change.

Educating Consumers: Transparency on how much of a price tag is pure product cost versus import fees can build trust.

Ready to see how import fees shape your spending? 👉 import fees