“Are U.S. Tariffs on China a Political Strategy or Economic Necessity?”

0

1

0

Since 2018, the U.S. has imposed escalating tariffs on Chinese imports under Section 301 and related measures. Proponents argue these duties protect American industries and correct trade imbalances, while critics view them as political tools aimed at projecting strength. In this article, we’ll dissect whether U.S. tariffs on China serve primarily as a political strategy or reflect genuine economic necessity—and what that means for businesses and consumers alike.

Table of Contents

1. Historical Context of U.S. Tariffs on China

2. Tariffs as Political Strategy

3. Tariffs as Economic Necessity

4. Industry Impacts and Consumer Costs

5. Stakeholder Perspectives on Tariffs

6. Future Scenarios: Balancing Politics and Economics

1. Historical Context of U.S. Tariffs on China

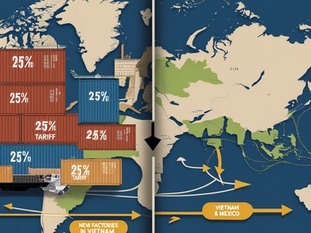

The modern wave of U.S. tariffs began in 2018 with 10–25% duties on $200 billion of Chinese goods, expanding to cover most imports by 2020. These measures responded to concerns over intellectual property theft, forced technology transfers, and a growing trade deficit.

Section 301 Investigations: Found unfair practices warranting duties.

Retaliatory Actions: China imposed its own tariffs on U.S. exports.

Escalation & Stalemate: Multiple negotiation rounds yielded limited rollbacks.

2. Tariffs as Political Strategy

Tariffs can serve geopolitical objectives beyond pure economics:

Leverage in Negotiations: Higher duties create pressure points in trade talks.

Domestic Messaging: Politicians showcase “toughness” on foreign competition to key constituencies.

Diplomatic Signaling: Tariff announcements often coincide with broader policy shifts or security actions.

By wielding tariffs publicly, governments gain visible tools to influence both domestic and international audiences.

3. Tariffs as Economic Necessity

Supporters contend that duties address real economic imbalances and protect vital industries:

Protecting Manufacturing: Shields steel, aluminum, and emerging tech sectors from underpriced imports.

Correcting Deficits: Aims to reduce the $300 billion annual trade gap with China.

Encouraging Reshoring: Incentivizes companies to bring production back to the U.S.

These economic arguments center on long‑run competitiveness and national security considerations.

4. Industry Impacts and Consumer Costs

Whether strategic or necessary, tariffs have tangible effects:

Supply Chain Disruptions: Companies scramble to diversify sourcing away from China.

Higher Consumer Prices: Duties are often passed on, adding 5–20% to price tags on electronics, apparel, and machinery.

Investment Shifts: Increased capital flows into domestic manufacturing and alternative markets like Vietnam.

The balance of costs and benefits varies widely across sectors and firm sizes.

5. Stakeholder Perspectives on Tariffs

Voices for and against tariffs illustrate the complexity of policy trade‑offs:

Industry Groups: Some manufacturers applaud protection, while import‑reliant businesses lament higher input costs.

Consumers: Surveys show mixed support—desire to “buy American” clashes with worries over pricier goods.

Economists: Debate whether tariffs spur inefficiency or catalyze innovation.

Understanding these viewpoints helps clarify both the political and economic stakes.

6. Future Scenarios: Balancing Politics and Economics

As U.S.–China relations evolve, so too will tariff policy:

Negotiated Rollbacks: Potential partial relief in exchange for structural reforms.

Targeted Exemptions: Carve‑outs for critical industries to soften economic pain.

Long‑Term Realignment: Diversified global supply chains reducing reliance on tariffs as a tool.

Policymakers must weigh the political optics of toughness against the economic imperative of keeping goods affordable and supply chains stable.

Ready to weigh in on policy and prices? 👉 tariffs