China’s Response to U.S. Tariffs: Retaliation or Restraint?

0

0

0

Since the U.S. began imposing escalating tariffs on Chinese imports in 2018, Beijing’s counter‑moves have been closely watched. Some expected aggressive retaliation, while others predicted a measured approach to avoid further escalation. In this article, we analyze China’s strategies—both direct and subtle—and assess whether its response reflects full retaliation or strategic restraint.

Table of Contents

1. Overview of U.S. Tariffs on China

2. Retaliation: China’s Countermeasures

3. Restraint: Signals of Caution

4. Economic Impacts of China’s Response to Tariffs

5. Strategic Calculations Behind China’s Choices

6. Future Outlook for U.S.–China Trade Relations

1. Overview of U.S. Tariffs on China

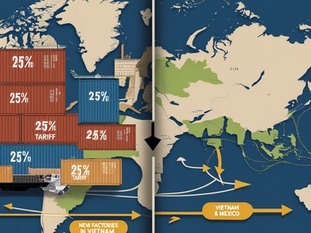

The U.S. applied Section 301 duties—ranging from 10% to 25%—on hundreds of billions of dollars of Chinese goods, citing unfair intellectual property practices and trade imbalances. These measures targeted key sectors like technology, machinery, and consumer products, setting the stage for Beijing’s response.

2. Retaliation: China’s Countermeasures

China’s immediate replies included:

Reciprocal Tariffs: Imposed duties on U.S. agricultural commodities (soybeans, pork), automotive parts, and chemicals.

Import Restrictions: Tightened inspection protocols on certain U.S. exports, delaying shipments.

Subsidies for Domestic Firms: Boosted support to local industries to offset U.S. duties.

These actions aimed to pressure U.S. exporters and underscore China’s willingness to fight back in the trade war.

3. Restraint: Signals of Caution

Despite these steps, China has often shown restraint:

Limited Scope: Many high‑profile products were excluded from retaliatory lists to protect domestic consumers.

Gradual Implementation: Tariff increases were phased in over months, not weeks, to soften shock.

Avoidance of Escalation: In key talks, Beijing signaled openness to negotiation rather than immediate tit‑for‑tat hikes.

Such restraint suggests Beijing weighs broader economic stability over short‑term leverage.

4. Economic Impacts of China’s Response to Tariffs

China’s mix of retaliation and restraint has produced multifaceted effects:

Agricultural Sector Strain: U.S. farmers lost a major market, driving down soybean prices by up to 20%.

Manufacturing Realignment: Some Chinese factories retooled to serve domestic demand, mitigating export losses.

Consumer Prices: Limited retaliatory coverage helped keep certain consumer goods prices stable within China.

The balanced approach protected key domestic interests while signaling resistance.

5. Strategic Calculations Behind China’s Choices

Beijing’s calibrated response reflects several strategic priorities:

Maintaining Growth: Avoiding wholesale export bans that would derail economic targets.

Negotiation Leverage: Using the threat of additional measures as a bargaining chip.

Global Image: Showing responsible stakeholder behavior to allies and multilateral forums.

These factors drive a blend of measured retaliation and tactical restraint.

6. Future Outlook for U.S.–China Trade Relations

With both sides retaining significant tariffs, the path forward hinges on:

Phase One Negotiations: Potential expansion of existing agreements to roll back select duties.

Bilateral Dialogues: High‑level meetings to address structural issues beyond tariffs.

Multilateral Engagement: Leveraging WTO and regional pacts to stabilize the trading system.

How China balances retaliation and restraint will shape the durability of any trade truce.

Ready to understand the dynamics shaping global commerce? 👉 tariffs